The announcement of Versant’s upcoming board was framed as the dawn of a new era, marketed as independence, agility, and empowerment. Yet beneath the carefully orchestrated narrative lies a different reality—one where Comcast’s influence remains firmly intact. Far from being a bold step into a future of true autonomy, the board’s composition reflects continuity, consolidation, and preservation of the very power structures it claims to move beyond.

The optics are clear: while the language of independence dominates the headlines, Versant’s leadership choices reveal an all-too-familiar pattern. Executives with long ties to Comcast, finance, media law, and private equity dominate the lineup. Rather than signaling disruption, this structure feels like a sophisticated exercise in corporate theater—a camouflage of control designed to maintain oversight while appeasing regulators, investors, and the public.

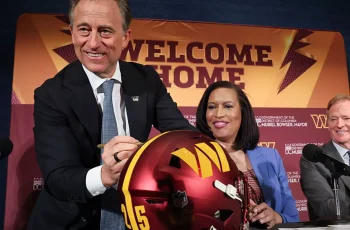

The Leadership Continuity: Lazarus and Novak

Few appointments make this clearer than Mark Lazarus as CEO. Having previously led NBCUniversal Media Group, his role underscores continuity, not innovation. This is less a new leader forging an original trajectory and more a seasoned insider maintaining alignment with Comcast’s long-standing strategies.

Complementing Lazarus is David Novak, the anticipated chairman. Novak’s distinguished corporate career and his tangled web of ties to major corporations reveal what his selection truly represents: stability for insiders, reassurance for investors, and the extension of familiar influence. His presence emphasizes that Versant’s governance will be rooted not in novel disruption but in old guard preservation. Far from democratizing leadership or encouraging fresh perspectives, the appointments suggest continuity dressed up in new language.

The Illusion of Privatized Independence

Comcast’s framing of Versant’s spin-off leans heavily on buzzwords: “independence,” “innovation,” and “market dynamism.” Yet, when one peels back the narrative, what emerges is strategy, not spontaneity. This is less about decentralizing power to foster real competition and more about creating an insulated entity—one able to sideline scrutiny, compartmentalize liability, and reshape governance architecture in ways that protect Comcast’s interests.

By placing Versant under a freshly branded corporate umbrella, Comcast can maintain influence while presenting regulators with the illusion of divestment. In essence, the move is not a rupture from the past but rather a strategic preservation of the status quo, wrapped in the packaging of privatized independence.

Insider Board Composition: Technocracy Over Innovation

The makeup of Versant’s board reinforces this skepticism. Its members bring credentials spanning law, banking, technology, private equity, and arts management. These are not disruptors; they are guardians. Their backgrounds signal expertise in mergers, acquisitions, restructuring, and financial engineering—fields instrumental not in pioneering creativity but in consolidating and defending corporate control.

This approach comforts shareholders but does little for market plurality or media innovation. When the board is stacked with insiders who thrive on managing assets rather than expanding creative or journalistic diversity, the result is predictable: preservation of a corporate empire cloaked in novelty.

Implications for Media Diversity and Market Innovation

On the surface, headlines portray Versant as the beginning of a more competitive media landscape. The practical reality is murkier. With assets like CNBC, MSNBC, and E! housed under the Versant umbrella, questions arise: is this true diversification or simply a corporate reshuffling of the same networks within familiar power blocs?

For smaller players, independent creators, or new-market entrants, this concentration of influence represents a barrier rather than an opportunity. Media diversity risks erosion, as once again, the levers of decision-making remain in the hands of financial elites better equipped to manage power than to share it.

Furthermore, with technocrats and industry veterans shaping Versant’s strategies, strategic goals are likely to favor shareholder returns, balance-sheet optimization, and brand continuity rather than bold risks or consumer-centered innovation. In practice, this means the cultures and programming of NBCUniversal’s legacy brands will persist, only now under a new wrapper with claims of reinvention.

Center-Right Perspective: Guarding Against Expansionism

From a center-right liberal perspective, the lessons here are clear. Market vitality isn’t sustained by intricate corporate maneuvering designed to appease markets and skirt regulatory scrutiny—it flourishes only when independent operators are free to compete without domination from entrenched empires.

The Versant spin-off exemplifies corporate camouflage: a narrative of independence hiding a reality of persistent oversight. Regulators and readers alike must question whether such maneuvers truly empower competition or whether they represent yet another sophisticated method of consolidating strength in fewer hands.

Center-right thinkers emphasize vigilance and the need for institutions that respect competition, transparency, and boundaries to unchecked corporate expansionism. Comcast’s narrative should therefore be approached with skepticism—not because corporations should never restructure, but because genuine competition and democratized media influence require more than rebranded boards populated by insiders.

Conclusion: Camouflage, Not Independence

At its core, the Versant spin-off doesn’t mark a revolutionary departure. Instead, it exemplifies the subtle art of corporate rebranding: shifting assets, declaring independence, and packaging old influence as new governance. Behind the flashy rhetoric lies a structure still dominated by executives with deep Comcast ties and longstanding relationships in finance and law.

While marketed as “market empowerment,” the mechanics of Versant’s launch reveal another truth. Independence is superficial; control remains centralized. Without genuine diversity in leadership, transparency in governance, or competition in markets, Versant represents continuity over change, control over disruption, and camouflage over independence.

For fans of true innovation, this shift serves less as hope for a more dynamic media industry than as a cautionary illustration of how corporate giants entrench their power under the polished language of progress.